This article is the first of a series called “I could already retire here: [City/Country]”.

Since I am planning to retire rather sooner than later (read: in the next five years), I am looking for countries where I could relocate once I decide to stop working. Currently, I live in Berlin, Germany, and to be able to stop working here would mean to have a passive income north of 2,000 Euro per month pre-tax (after health care and capital gain tax probably more like 1,000 Euro). Therefore, I am looking for countries where I could retire where both cost of living and taxes would be significantly lower.

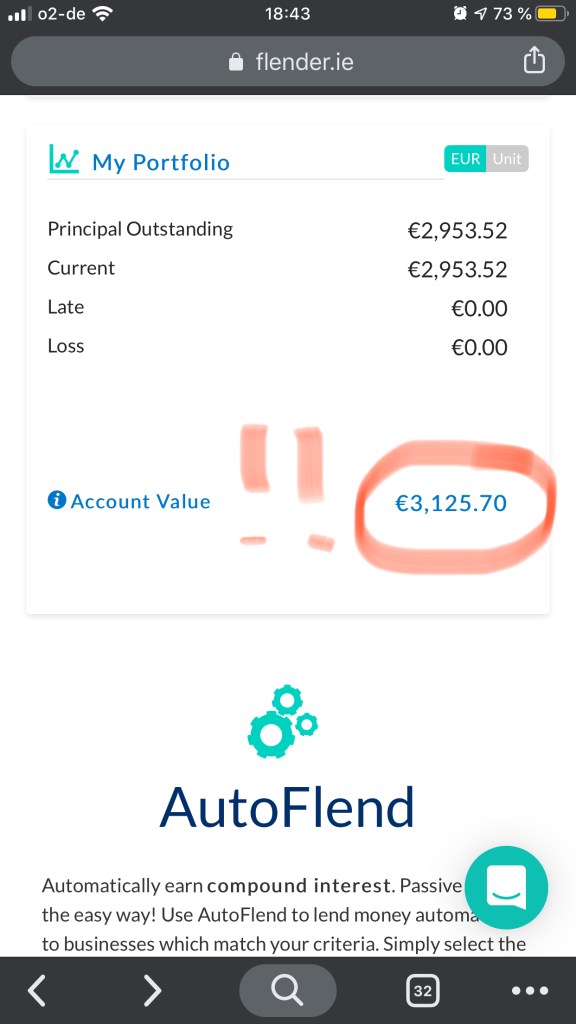

With a passive income of around 320 Euro per month, the list of potential countries I could move to, is quite short. worlddata.info lists the average income per country. At the bottom of the list, we have countries like Madagaskar, Afghanistan, and Nigeria. In fact, in the 15 countries with the lowest average income, there is only one European country, namely Ukraine. So if I were to retire now, I would have to look for a country outside of Europe.

Retire in Vietnam

To retire in Thailand on the average salary, I would need 551 $ or 499 €. So the most popular SEA country for expats is currently out of the question and might never be a convenient option, since expats are starting to leave the country for Vietnam due to the introduction of stricter visa requirements in Thailand.

Thus, Vietnam might not be such a bad choice after all. And the average income there is 200 $ or 181 € – which means that if I were to only spend that sum per month, I wouldn’t have to work anymore while also having money left over to invest and increase my passive income over time.

The wishlist

When looking at alternative countries, I have some criteria, the countries in question should meet:

- A safe country without human rights violations

- Low cost of living with decent quality of life

- Somewhat international demographics

The first point is a given – risking my life/sanity for a lower cost of living would be a pretty bad life choice. Low cost of living with a decent quality of life simply for me means as long as the health care in the country is at least average and my basic necessities are met (such as heating, running water, healthy food), I’m game. The third point could be a bit trickier – from my experience when living abroad, I tend to not immerse myself in the local culture but instead form friendships with other expats. If I were to move somewhere where there are no expats and the locals don’t speak English would result in me being pretty isolated and I would seriously question my decision.

Da Nang, Vietnam

According to theculturetrip.com, Da Nang, the country’s third biggest city, has been voted the most livable city in Vietnam. It’s clean and organized and has beaches and mountains. With a population of 1.3 million, it’s a third of Berlin and a good size to offer enough diversity while not being overwhelming (of course, since I have never been to South East Asia, this is just a guess – I would have to travel there to see for myself).

Human rights, health care & visa

Human Rights Watch lists quite a few violations and it doesn’t seem like the situation is going to improve any time soon. Before actually moving / visiting, I would have another detailed look and educate myself.

When it comes to health care, Vietnam would not be my first option – a quick search revealed that their system is grossly underfunded so I would have to get a good international health insurance to be able to use private hospitals.

When I think about my future, I see different countries (plural!) and slow travel. That means, I wouldn’t relocate to a country and turn my back on Germany or Europe. Instead, I would probably live some months in that country and the rest of the time I would spend visiting friends and family or do some really slow slow travel. Which means, that I could move to a different country with a student visa and live & study there until I get bored.

The expat retiree

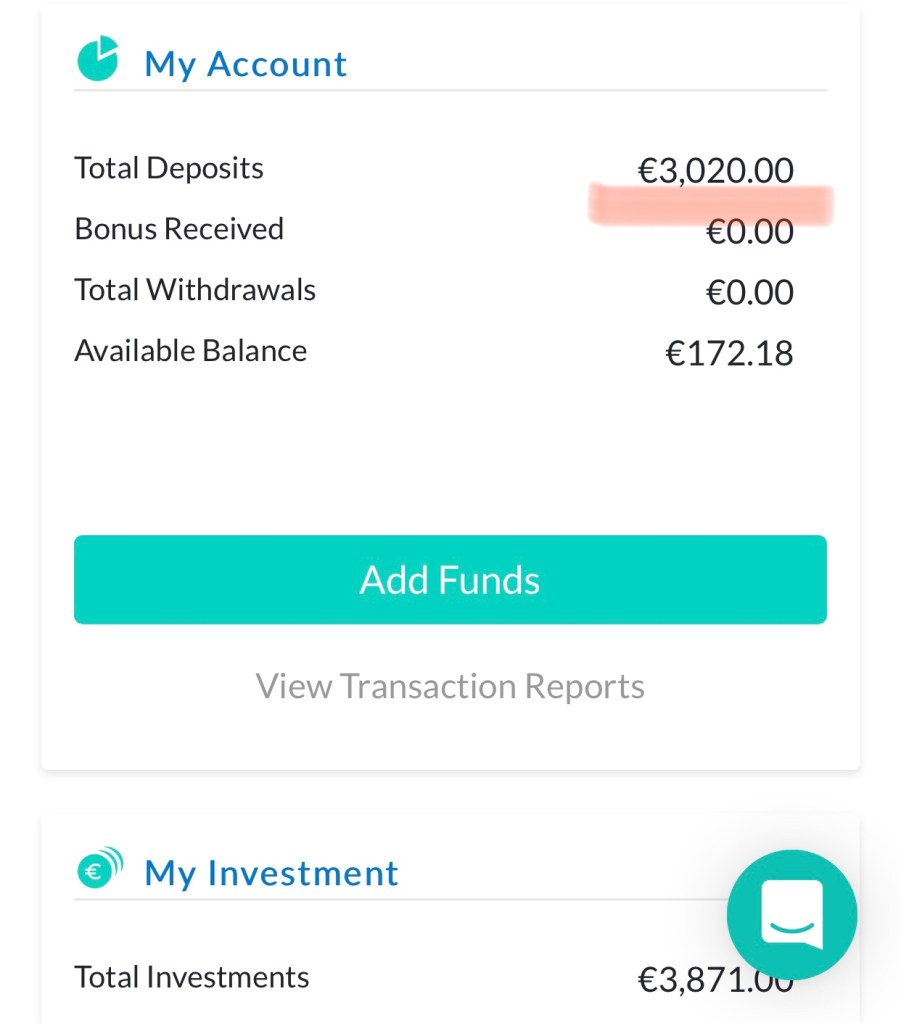

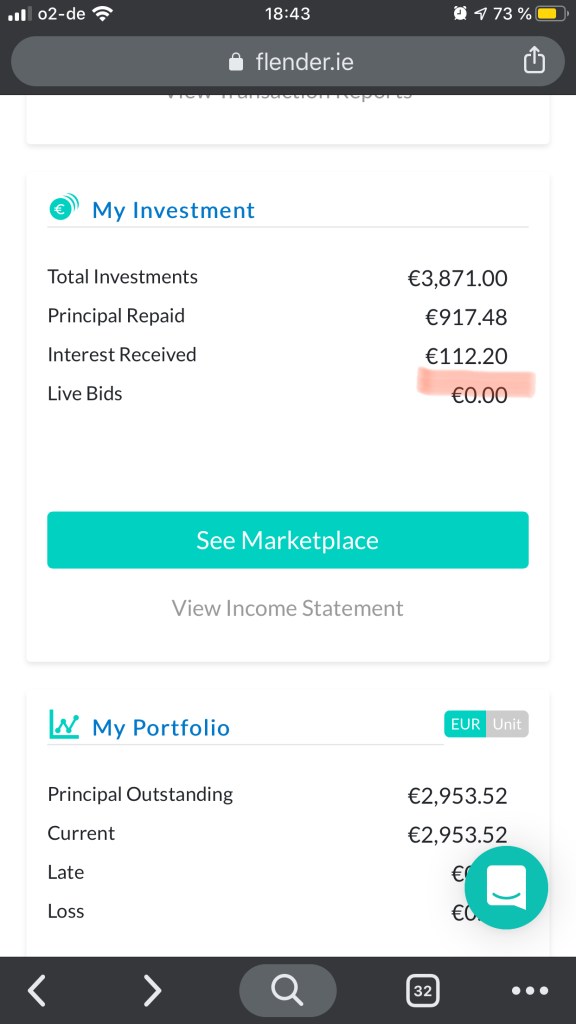

Personal capital gain tax from interests is a flat rate of 5%. Compare this to 25% (or your personal income tax rate) in Germany and a move to Vietnam makes even more sense. Also, having a base in Vietnam means

- I would live where other people vacation

- Whatever I don’t spend, I can reinvest to increase my passive income or

- Live there cheaply a couple of months and use my savings to visit more expensive countries like Australia without having to dip into my invested money

Conclusion

The numbers mentioned in this article are taken from the internet, so they should be taken with a grain of salt. While the average salary is 200$, I don’t know if this is actually sufficient to have an average life in Vietnam – after all worlddata.info states that the average monthly income in Madagascar is 37$ – that’s why this series is called “I could already retire here”, not “I am retiring here”. Before moving half way across the world, I would run the numbers again and evaluate the risks and benefits.

Thank you for reading