I invested in the p2p platform flender.ie and here is what happened

An honest review

After having read about financial independence and investing for years, I finally got serious about it about 1.5 years ago. Following the rule of maximal diversification, I looked at different p2p platforms to invest in. I had started investing on another Irish linkedfinance.com a couple of years ago (just a small sum) and when I learnt about a second Irish SME p2p lending platform, I didn’t hesitate long.

There were a couple of reasons why adding Flender.ie to my portfolio made sense:

- I had already invested in some platforms in the Baltic countries and wanted to geo-diversify

- I prefer SME p2p lending platforms over consumer lending p2p lending platforms

- Easy transfer of funds: just like on LinkedFinance, I could deposit funds with my credit card and allocate them moments later

- As per their website, they had an impressively low default rate of 0.2% (it has since gone up to 0.7%)

- No fees for investing

- No fees for withdrawing (which would be convenient once I wanted to withdraw interest payments)

- Interest rate of about 11% which is not the best interest rate out there but still more than ok

- The reviews I read on other blogs convinced me that flender.ie was a solid platform

Creating an account

So I decided to create an account and deposit funds. Compared to LinkedFinance (their direct competitor in the Irish SME p2p lending industry), they have less investment opportunities so after I deposited some money, there was quite a bit of a cash drag. Yet, I didn’t let that bother me, since I was in for the long haul. Or so I thought.

At first though, I was quite happy. My money got completely invested over the course of I think two months and the interest payments started rolling in. Regularly and without delay. Indeed, none of the loans got delayed so for me the default rate was even 0.0%. What more could one want?

Customer service

I am still in the phase of testing out different platforms and one factor that is important for me to check out is always how fast and helpful their support is. Not having any control when something goes wrong and having to rely on their support to respond fast and resolve issues is key to letting me sleep at night. That means, whenever I have a question I want answered, I reach out to their support via email to have my question answered to see how they answer to my query and resolve my issue.

Lower interest rates & delayed interest payments

Not long after LinkedFinance announced to make changes to their interest rate, I was sort of expecting Flender.ie to follow suit. And indeed they did – they send an update via email to their investors informing them about it and the average return from their platform is now a bit lower at 10.3%. While an interest rate of 10.3% is nothing to turn your back on, a couple of days before that, they also introduced a change in their repayment method for their borrowers. They claimed to introduce repayment via Direct Debit to improve the repayments for both investors and borrowers. They also said that Direct Debit needed clearance times and as a result, interest payments would now be up to 10 days delayed. While I understand that it makes no difference for borrowers and might even be more convenient than before, I am not so sure how delayed repayment dates (up to 10 days even!) would be an improvement for investors. Yet, this is what their email stated.

Checking interest payments and monitoring my account

Since I’m so new to building passive income, every interest payment is exciting – the thought that every euro takes me closer to financial independence puts a smile on my face every day (hello slow travel, here I come…). So naturally, when I read the email about changed interest repayments, I started taking an increased interest into what was happening on my account. When they changed the repayment method in October and due to the potential delay of 10 (!) days, my returns for October took a hit, since some of the October interest payments were paid out in November, instead.

Of course, a delay only means that the returns in October were lower than expected but then going forward should be back to normal. I might be impatient, but I’m not unreasonable. I decided to keep a close eye on my account in October and November just to make sure everything was going as per plan. Namely, to have my account value go up over time.

How Flender.ie loses their investors’ trust

To maintain an overview over my investments, I track interest payments in an excel file. And that’s when I noticed one day, that my overall account value seemed to have dropped from the previous day. As I already mentioned, I’m not one to shy away from contacting customer service (and I had done so once before and they fixed the issue within a day or two) so I emailed them and asked them to please look into my account, as it seemed that my account value got lower from one day to the next – which is virtual impossible if all loans are on time, interests are paid and there is no fees of any kind.

And this is how it all started. They convinced me, that everything was in order – that in fact there was no drop in the account value, they provided the account value over the course of multiple days and the interest payments on those days. Well I wasn’t convinced but after exchanging multiple emails, I decided to put the issue to rest. A drop of a couple of euro shouldn’t put my FIRE plans in jeopardy.

Flender.ie account value vs. deposited funds + total interest

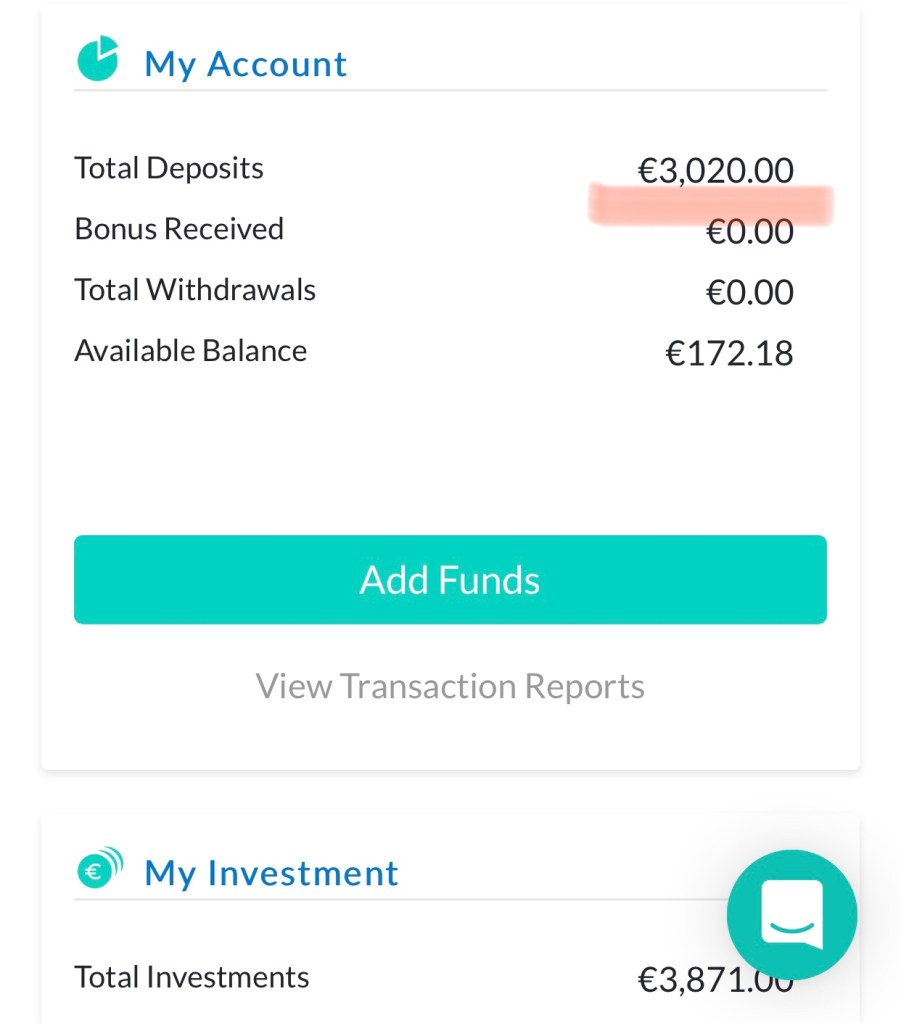

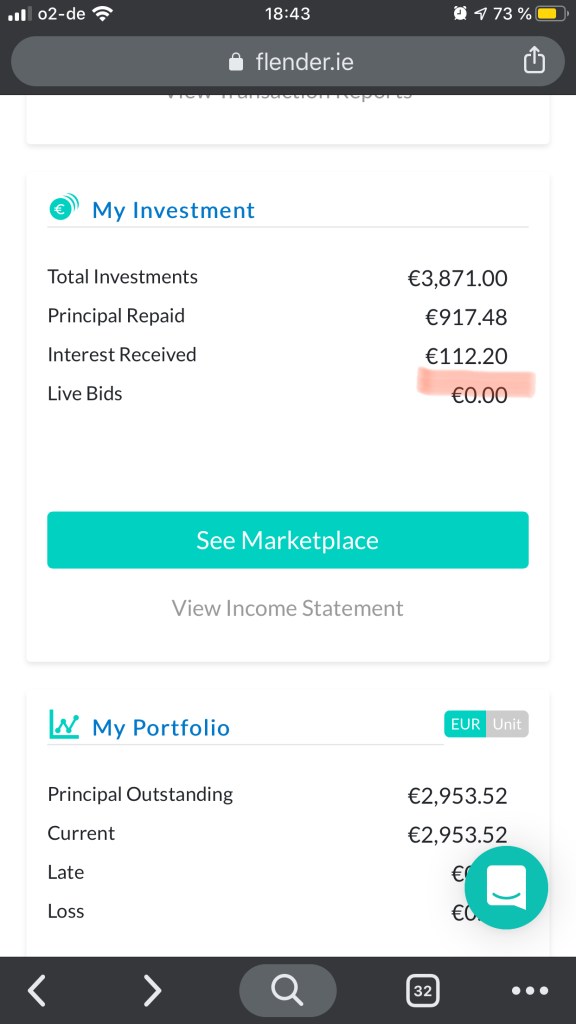

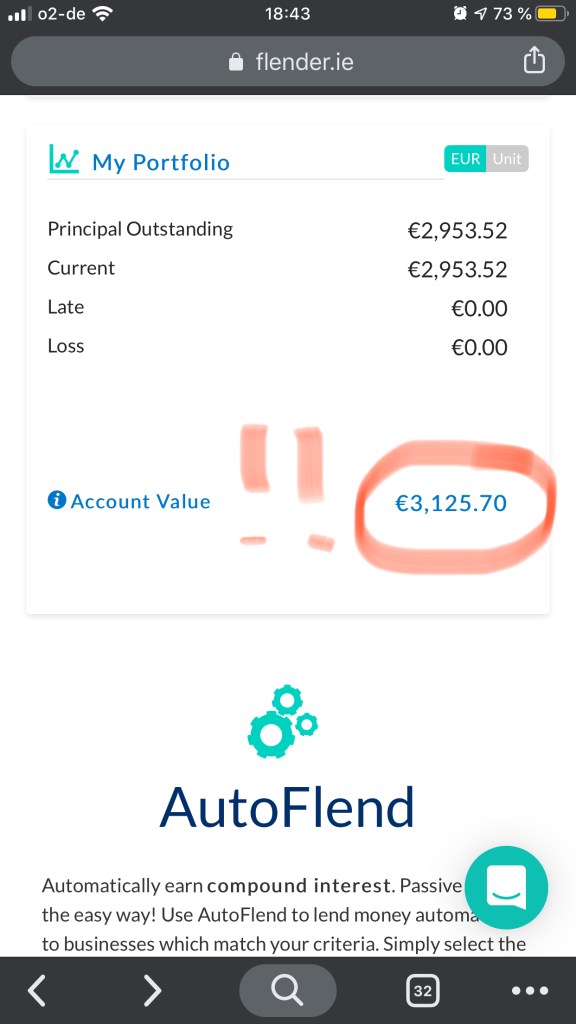

Still trying to let the whole issue go, I was looking at my dashboard a couple of days later when I noticed something peculiar. I had deposited 3,020.00 Euro into my account and had acquired 112.20 Euro. Yet, instead of showing 3,132.20 Euro, my account value was 3,125.70 Euro. I felt relieved – there had been a mistake on their side and if I would reach out to them, they would fix it, surely.

I immediately sent them an email to let them know that the account value wasn’t updating properly – an IT bug probably, easy to be fixed. Imagine my surprise, when I received an email that in fact the account value was correct: because the account value as flender.ie defines it is outstanding principal plus available balance: 2,953.52 Euro + 172.18 Euro = 3,125.70 Euro.

So I sent them another email to point out that if there are no fees, then something is wrong and that they should look into it again. I got the response that I indeed got 112.20 Euro and that the account value as they calculate it, was correct. At this point, anyone would get frustrated and so did I – sent them another email and asked them if they could guarantee that if I removed all my funds, it would be invested funds + total interest received. To which I got yet another reply that I could withdraw the amount in available balance.

Invest in fender.ie?

Yes exactly, Flender.ie is doing some dodgy math acrobatics to trick investors out of some money. I know in my case it’s just a difference of a couple of euro but if they do that to every investor, they will get quite a nice sum out of it.

I did expect them to check and fix their mistake but instead, I got the same answer over and over.

In case someone from the Flender.ie management reads this: if you want to increase your profits, be transparent and introduce fees. Don’t try to fool your investors – your business might not survive it.

To everyone else reading this – I lost trust and confidence in Flender.ie and will remove my funds as soon as I can.

Thank you for reading